The New to R&D Grant supports entrepreneurs at the “getting started” stage of their innovation journey. They’ve formed a business around an exciting new idea or concept, are looking for some initial research and development (R&D) funding, and would benefit from starting their own in-house R&D to put them on the path towards commercial success.

The grant comes in two parts, which work in parallel. If you apply, you'll put forward a proposed plan and budget for your first structured R&D project, to push forward your new idea or concept. This first R&D project often has the steepest learning curve and the most exciting, future defining outputs, and provides vital hands-on experience to use for many years to come.

Alongside the first project, you will also receive funding to build R&D skills and capabilities within your business. Our scientists, engineers and R&D experts have identified six areas of essential skills and capabilities that innovators should possess to become long term R&D performers. You’ll choose learning activities that are most likely to fill skill gaps, directly impact the progress of your idea and enhance your R&D project.

Like many other government grants, recipients will need to secure co-funding. For every dollar spent by a recipient, 40 cents come from Callaghan Innovation, and the other 60 cents come from their own funds, or via private investment. The co-funding supports a maximum total combined costs of $1m (40% - $400,000), covering both skills and capability building and R&D project costs.

Your business is unique, so your R&D should be unique too. All of this new and unique knowledge has a positive impact on the innovation ecosystem, which in turn plays a vital role in driving economic growth and future prosperity in Aotearoa New Zealand.

We know R&D can be uncertain and there’s no guarantee of yielding the results you want. But with that initial groundwork done - your ducks in a row - you can feel more confident that you’ll get to the right outcome as fast as possible, for all of your future R&D activities.

Benefits to your business

Receive vital funding to start your first structured R&D project.

Equip your team with a set of skills and knowledge needed to undertake effective R&D for years to come.

Undertake R&D activities more efficiently, and reduce risks of misspent time and money.

Open the doors to future R&D funding, including the R&D Tax Incentive.

What is R&D?

Research and development is so much more than just giving something a go to see if it works. If what you're doing ticks these three boxes, we recognise it as R&D.

Your activity seeks to resolve scientific or technological uncertainty: a competent professional in the field is unable to answer your question.

Your activity seeks to create new knowledge, or new or improved processes, services or goods: you're seeking something that doesn't yet exist in the world.

Your activity follows a systematic approach: working with a plan, in a thorough and efficient manner.

Ready for the R&D Tax Incentive

With your newly found R&D capabilities, skills and knowledge, and your first R&D project underway, it’s highly likely that your business will become eligible for the R&D Tax Incentive (RDTI): a 15% tax credit that can be claimed annually against eligible R&D expenditure.

Since its launch, the RDTI has provided over $300m in credits, and supported over $2bn of R&D investment.

An introductory session with the RDTI Engagement team will help you understand all the eligibility criteria, ensure you’re collecting the right information throughout the year and lend a guiding hand as you progress towards filing your application.

Find out more about the R&D Tax Incentive.

New: Increased R&D threshold and co-funding flexibility

From September 2024, we’ve increased the threshold for R&D spend, making more businesses eligible to apply.

Now, you’ll need to have spent under $150,000 on R&D over the last three years to be eligible. This is a threefold increase from the former figure of $50,000.

Additionally, if an applicant does not have their co-funding available at the start of the grant but is close to securing it from an external source, the grant can be approved in principle with a short window (maximum 6 months) for the applicant to secure the funding.

How the funding works

The grant will fund 40% of your eligible R&D activities and Capability Development building, up to the maximum total of $400,000. This means for every dollar spent by a recipient, 40 cents come from Callaghan Innovation, and the other 60 cents come from their own funds, or via private investment.

As part of the funding agreement, you will be required to conduct activities from between two and six different Skills and Capability Development categories (above). You’ll need to provide the details of your chosen Capability Development activities as part of your application.

Additionally you’ll need to demonstrate how your chosen capability development will build knowledge in the business, and the impact it will have on driving long-term R&D performance.

Your capability development activities should comprise no less than 5% of the total grant funding.

Example (broken down below) : Your costs are $1,000,000. You will receive $400,000 total in co-funding, requiring you to fund the remaining $600,000.

| Activity | Costs | 40% funded by Callaghan Innovation |

|

Skills and capability development: Intellectual Property training |

$30,000 | $12,000 |

| Skills and capability development: Regulatory & Compliance training | $20,000 | $8,000 |

| Skills and capability development: Project Management | $50,000 | $20,000 |

| Your chosen R&D activities | $900,000 | $360,000 |

| Total | $1,000,000 | $400,000 |

Is this right for me?

As the grant is specially designed for those new to R&D, applicants who have previously invested in R&D or applied for other government R&D funding are not eligible.

As a first step, your business must:

-

- Your business is an eligible entity

- Your business must not have received any government funding for R&D greater than $5,000 in the three years prior to the date of submission of your application

- Your business must have spent less than $150,000 in total on R&D over the three years prior to the date of submission of your application

- You must be able to fund your 60% share of the R&D costs.

You can read the full eligibility criteria on the New to R&D Resource Hub.

You'll be asked to provide evidence for your 60% share of the co-funding. Read our evidence of funds advice, to see what evidence is suitable.

If you do not have co-funding available at the start of the grant and you are close to securing it from an external source, the grant can be approved in principle with a short window (maximum 6 months) to secure the funding. Speak with your customer Navigator or Funding Engagement Specialist to find out more.

If you are part of a corporate group containing other R&D performing businesses, you may not be eligible to apply. You will be assessed on whether you have access to the capabilities of those businesses to assist you with your R&D. See our grouping guidance here.

The New to R&D Grant supports entrepreneurs at the "getting started" stage of their innovation journey.

You may be a completely new venture in its startup phase, or an existing business that has not really delved into R&D.

You could be from a scientific or engineering background and need further knowledge and skills in business and understanding the customer. You could be from an entrepreneurial background and need further knowledge in research methodology or deeper technical analysis.

What’s most important is acknowledgement that you and your team have skills and knowledge gaps that you want to fill to effectively drive your future R&D projects.

As the grant is specially designed for those new to R&D, applicants who have previously invested in R&D or applied for other government R&D funding are not eligible.

As a first step, your business must:

-

- Your business is an eligible entity

- Your business must not have received any government funding for R&D greater than $5,000 in the three years prior to the date of submission of your application

- Your business must have spent less than $150,000 in total on R&D over the three years prior to the date of submission of your application

- You must be able to fund your 60% share of the R&D costs.

You can read the full eligibility criteria on the New to R&D Resource Hub.

You'll be asked to provide evidence for your 60% share of the co-funding. Read our evidence of funds advice, to see what evidence is suitable.

If you do not have co-funding available at the start of the grant and you are close to securing it from an external source, the grant can be approved in principle with a short window (maximum 6 months) to secure the funding. Speak with your customer Navigator or Funding Engagement Specialist to find out more.

If you are part of a corporate group containing other R&D performing businesses, you may not be eligible to apply. You will be assessed on whether you have access to the capabilities of those businesses to assist you with your R&D. See our grouping guidance here.

The New to R&D Grant supports entrepreneurs at the "getting started" stage of their innovation journey.

You may be a completely new venture in its startup phase, or an existing business that has not really delved into R&D.

You could be from a scientific or engineering background and need further knowledge and skills in business and understanding the customer. You could be from an entrepreneurial background and need further knowledge in research methodology or deeper technical analysis.

What’s most important is acknowledgement that you and your team have skills and knowledge gaps that you want to fill to effectively drive your future R&D projects.

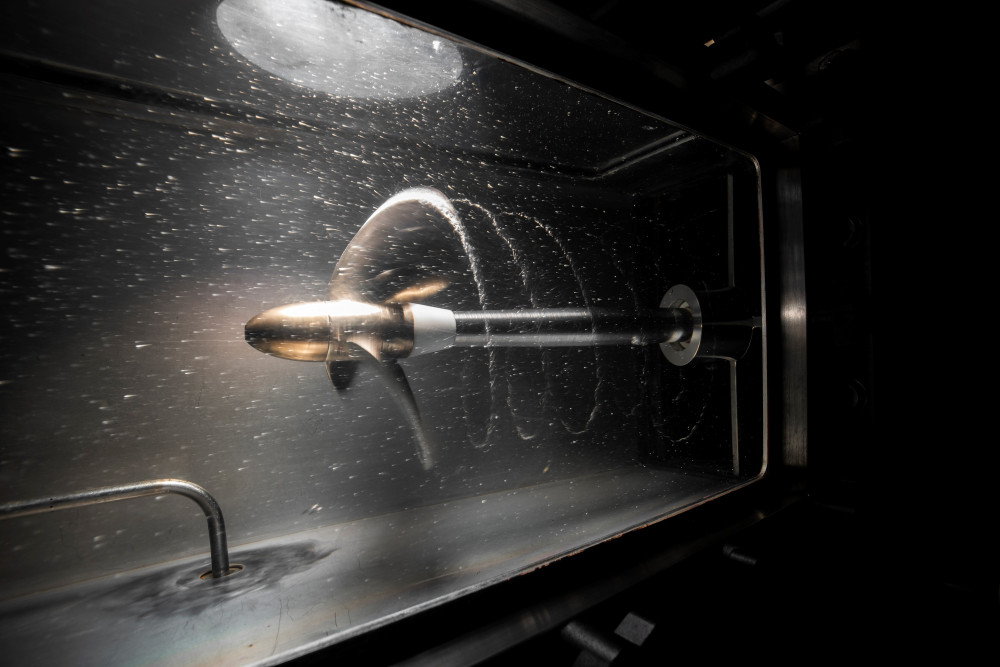

The New to R&D grant is having a significant impact on our business. Eighteen months ago, I had an idea. Now we have several products ready for market and a company with 25 employees in Palmerston North, as well as several overseas subsidiaries. I would have never thought that the solar powered robot mower idea would take us on this amazing journey. We cannot thank Callaghan Innovation enough!

""The New to R&D Grant is not only helping us advance our R&D efforts, it's supporting us to build new skills and knowledge in the areas of Intellectual Property and Regulatory and Compliance. unió is Kiwi innovation solving a global problem, so it's critical we protect our IP and understand regulatory requirements in key markets. At unió we are purposefully taking a long term view of R&D, as this underpins our mission to create more responsive, smaller footprint homes that are better for people and the planet."

"Frequently asked questions

If you have previously received a student grant (Experience, Career or Fellowship grant), you are not eligible to apply for the New to R&D Grant. However, if you are approved for a New to R&D Grant, you may apply for a student grant in the future.

No - if you do not need any capability development, you are not eligible and should move to the RDTI.

Read all frequently asked question on the New to R&D Grant Resource Hub

Resources

Ready to transform your business?

Start your application today!

To get started with the New to R&D Grant, please contact our Customer Support team.