A little over five years ago, the Research & Development Tax Incentive (RDTI) was introduced. Its intention was to incentivise business R&D activity, which would lead to economic growth for New Zealand.

Offering a 15% tax credit on eligible R&D expenditure, it marked a significant shift to how government support for innovation was delivered. Built into the legislation that introduced the scheme was the requirement that the scheme would be independently evaluated every five years.

The first five years are up, and Motu Research, supported by the University of Otago, has completed the first evaluation. We’re excited to share the positive results. You can read the full report here, and as you’ll see below, the key findings show a scheme that’s achieving much of what it set out to do – and it’s only getting started.

Highlights of the review

-

- 1,752 firms accessed the RDTI between 2020 and 2024, receiving an estimated $1 billion in tax credits (nominal)

- Firms supported by the scheme spent on average $274,000 more each year on R&D than they would have otherwise

- The RDTI generated an estimated $1.83 billion in additional R&D activity

- For every dollar of government spend, firms spent $1.40 on additional R&D, aligning with international benchmarks

- Mid-range economic modelling suggests the RDTI has delivered around $6.77 billion in positive impact to the economy – about 4.2 times the government's investment.

- Businesses reported positive impacts on their R&D and growth and emphasised the importance of stable R&D policy settings.

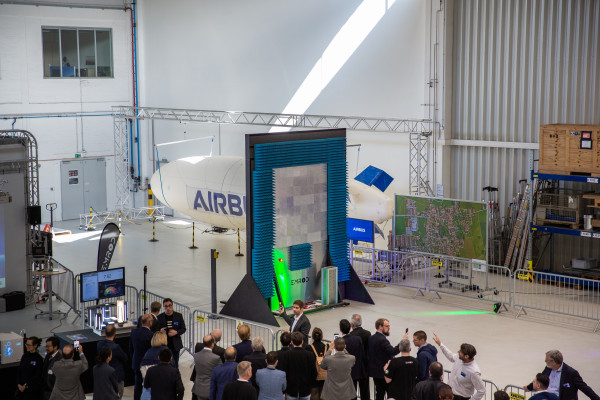

The review also highlighted the importance of the support wrapped around the scheme’s customers – which is where our team comes in.

Our Engagement team is your first port of call. They’ll walk you through the eligibility criteria, help you figure out what information to collect, and support you as you prepare your application.

We’re here year-round and support is tailored to your business, whether you’re a first-time applicant or looking to streamline your latest claim. The service is also completely free, with no consultancy fees or hidden costs.

The review found this hands-on support makes a real difference, especially for smaller businesses or those just starting out on their R&D journey. It’s helping more companies feel confident navigating the process and, ultimately, invest more in innovation.

So, if you’re wondering how your business can take advantage of the RDTI and do more R&D with less, now’s a great time to explore how the RDTI could support you.

Get in touch and see how we can help.