We are still accepting applications for all current grants listed below (unless otherwise specified). Our funding products will remain available and will transition to MBIE.

Empowering independence, growth, and long-term success is at the heart of our approach to funding. We offer grants, tax incentives, and other financial support to help you seize new opportunities and drive innovation. Our aim is to help you secure the funding you need so we also provide guidance and advice to help you get it. From nurturing future talent to R&D initiatives to taking world-leading innovations to market, we're here to provide the funding or assist you in finding it.

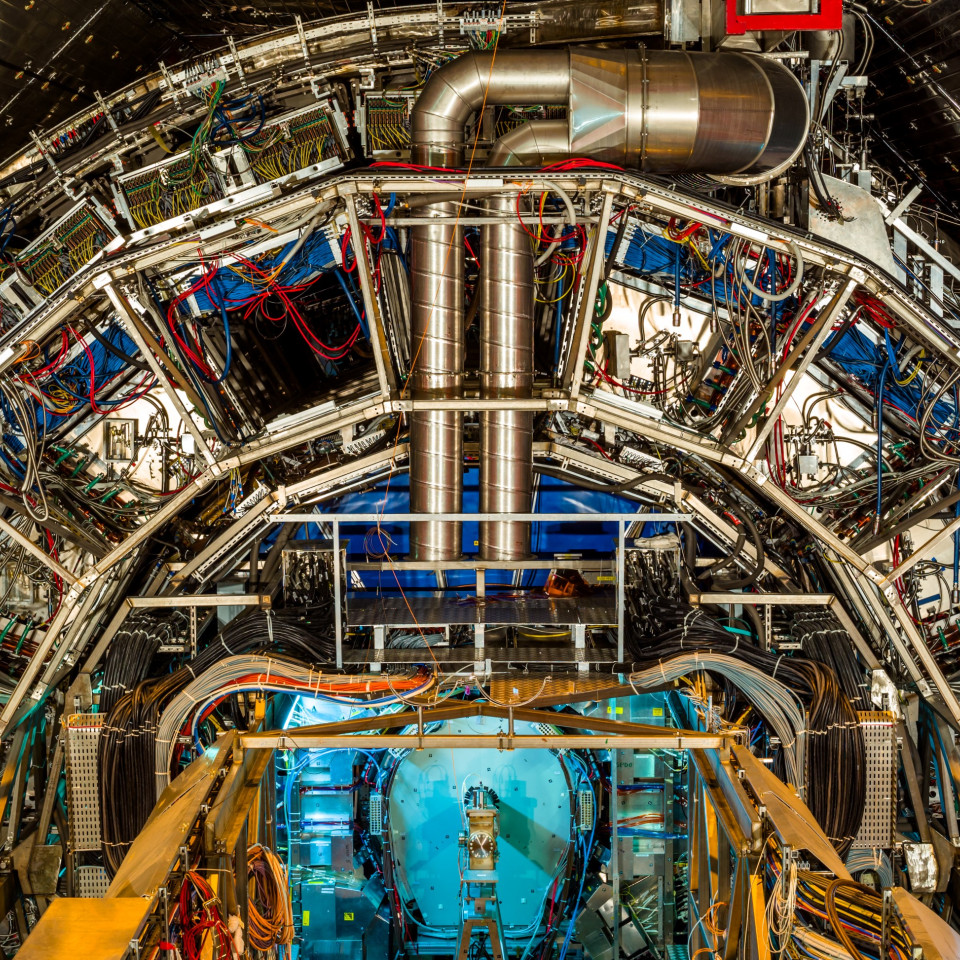

Long-term backing and investment to launch your Deep Tech venture, drive forward scientific and technological advancements, and make a positive impact on the world.

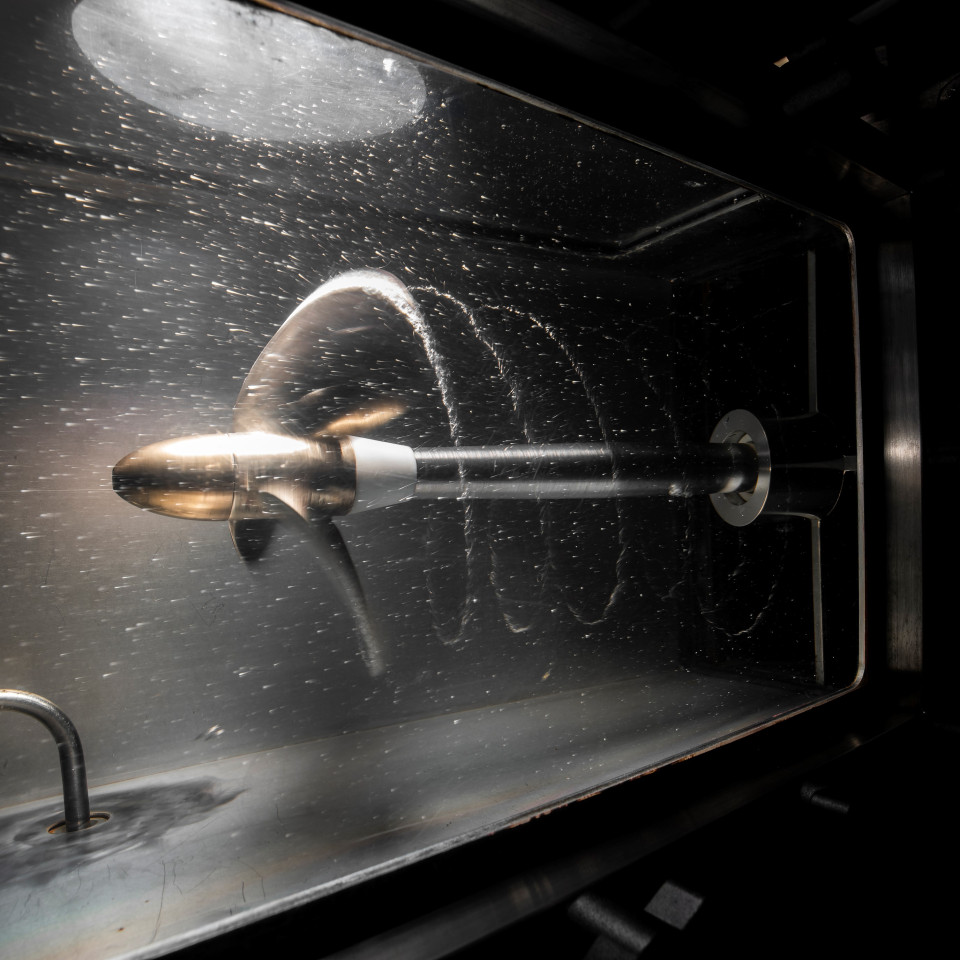

Funding and support to develop your skills, knowledge and capability, to help you find long-term R&D success.

Applications Closed

Applications for 2025 now closed

Claim a 15% tax credit on your eligible research and development costs, with free tailored support from our dedicated team.

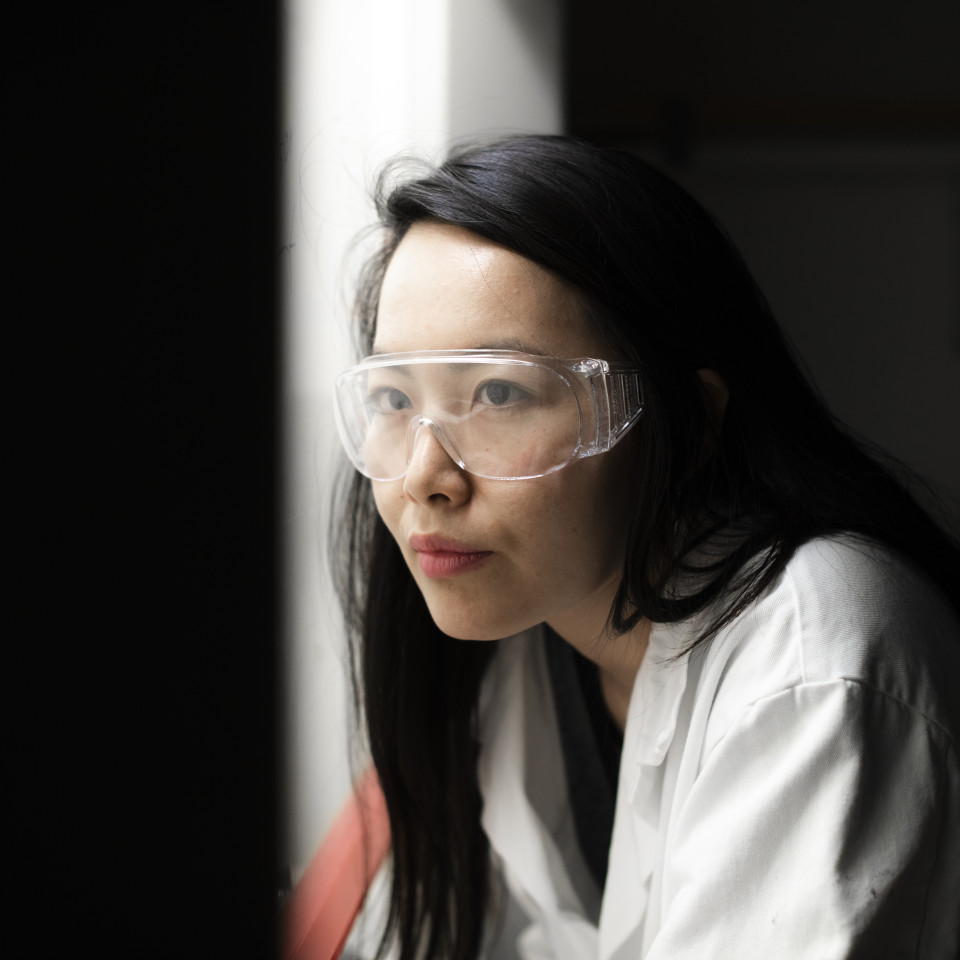

Funding for the game-changers, to take those vital final steps to market, and keep creating opportunities for other innovators in Aotearoa.